SAP Upgrade & Improvements In HR : SOP For Option To New Tax Regime - SAP - HR

Post the SAP upgrade, the following improvements in HR is done:

1. Changes related to new Income Tax regime is provisioned in CSI. SOP for the same is shared below.

2. The designation of the approver in respect of the leave spells that are approved after yesterday’s SAP upgrade is correctly appearing.

3. PCP0 posting performance issue has been improved.

4. Inflated ‘Gross pay’ issues has been fixed.

CEPT - HR Team

Standard Operating Procedure :

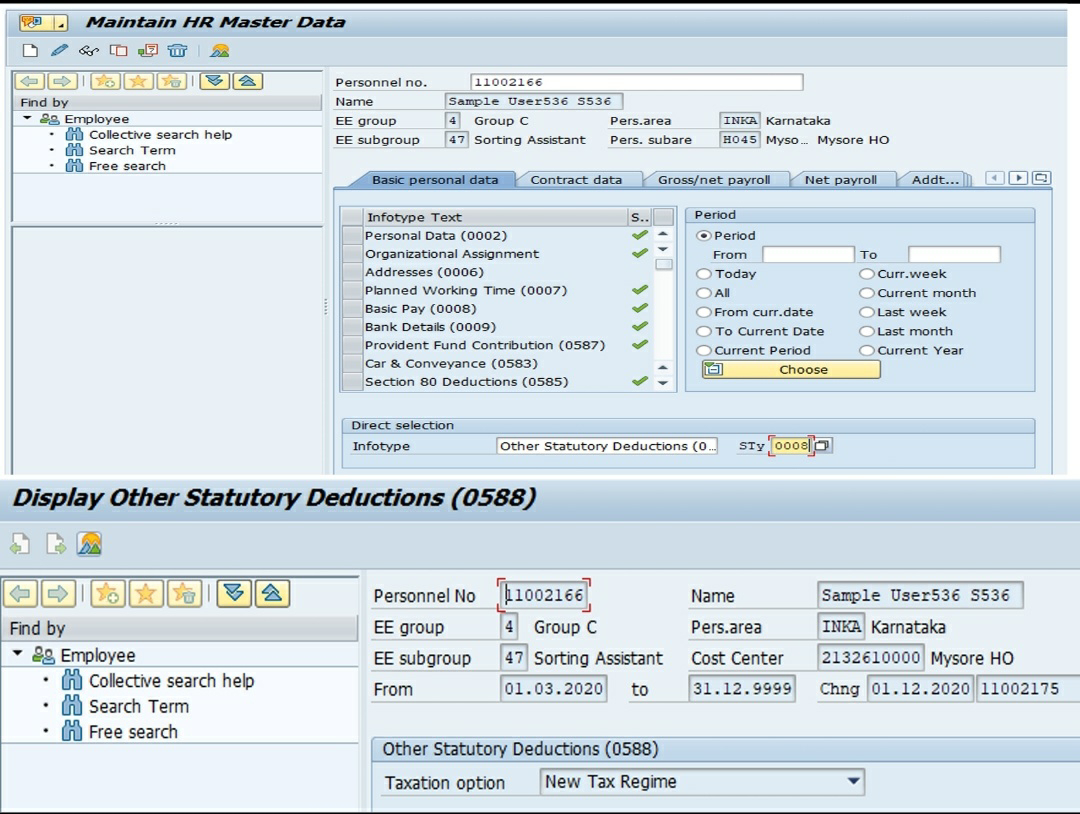

India Post SAP-HR has been provided with the facility of choosing the Tax option.

On rollout, by default, the tax option would be in OLD Tax regime for all the employees, which would keep all the employees as in current status without any change of taxation.

When the employee wants to switch to the new tax regime:

The employee will intimate the TAX option to the DDOs, if change in tax option is required.

The change in tax regime can be done individually by the DDO using the

T-code PA30

Info Type 0588,

Sub Info type 0008 & SAVE

DDOs may also use the mass upload of the option using the

T-Code: ZHR_IT0588_UPD

The Upload Format is furnished here under:

1 -Old Tax Regime

-New Tax Regime.

Here, the column of tax method should be in text format, but data to be maintained as "1" or "2" as the option.

Note: The change to new tax regime would be possible from 01.03.2021 or the Date of joining, whichever is later

.jpg)

Comments

Post a Comment

Thanks For Putting Interest